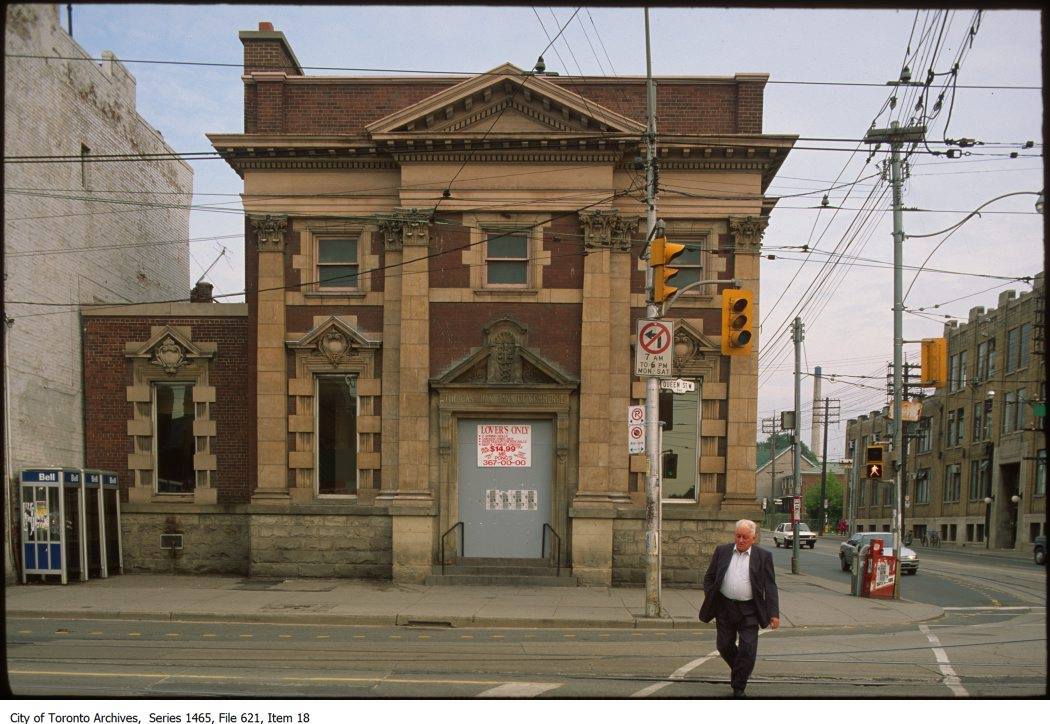

Bank failure, consolidation, and closure swept away the branches of the Canadian Bank of Commerce and the Home Bank of Canada that once anchored the intersection of Bathurst & Queen in Toronto, but their stately buildings survived to serve as a tattoo parlor, a drop-in services center for people experiencing homelessness, and, uh, the Chaos Theatre in the Scott Pilgrim graphic novels.

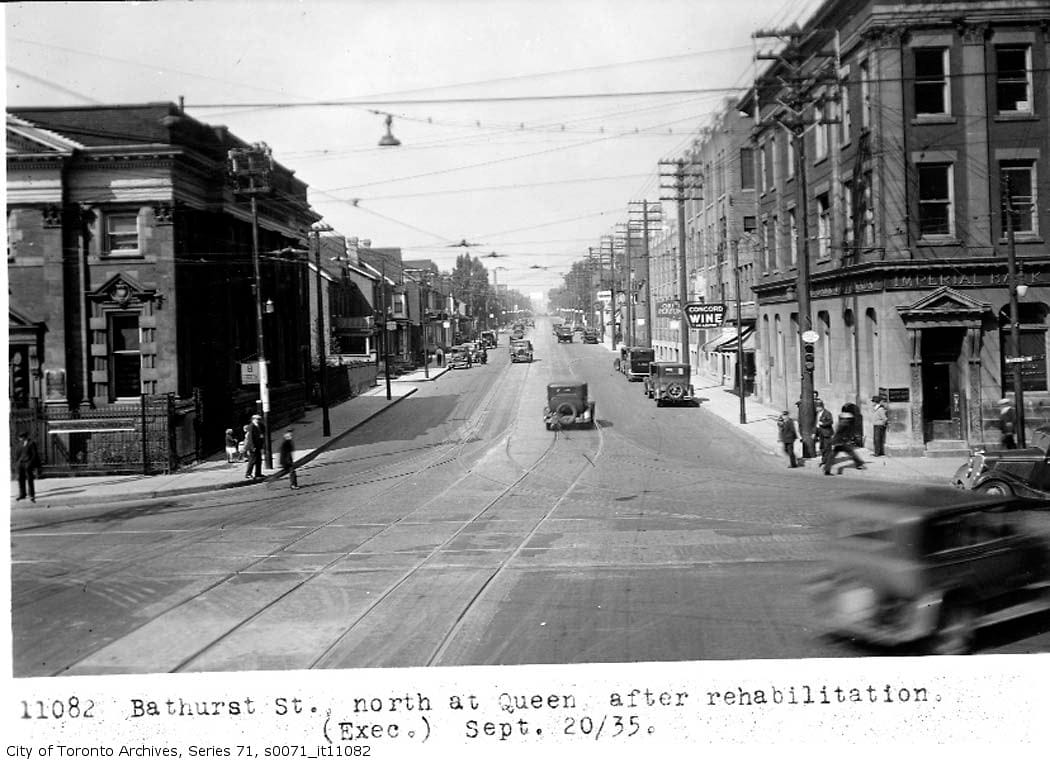

So, what’s changed? Well, awnings really fell out of fashion (or, frequently, were regulated away), and Bathurst St. has filled in a bit north of Queen. The Home Bank building lost the pediment above its front door, along with some other major changes to the first floor fenestration. Otherwise, though, not a lot of change in 115 years (...not necessarily a good thing, as Toronto added more than two millions residents in that time frame).

(…also, the catenary wires for the streetcar were already there when this postcard was published in 1910—I don’t know why they always show up so faintly.)

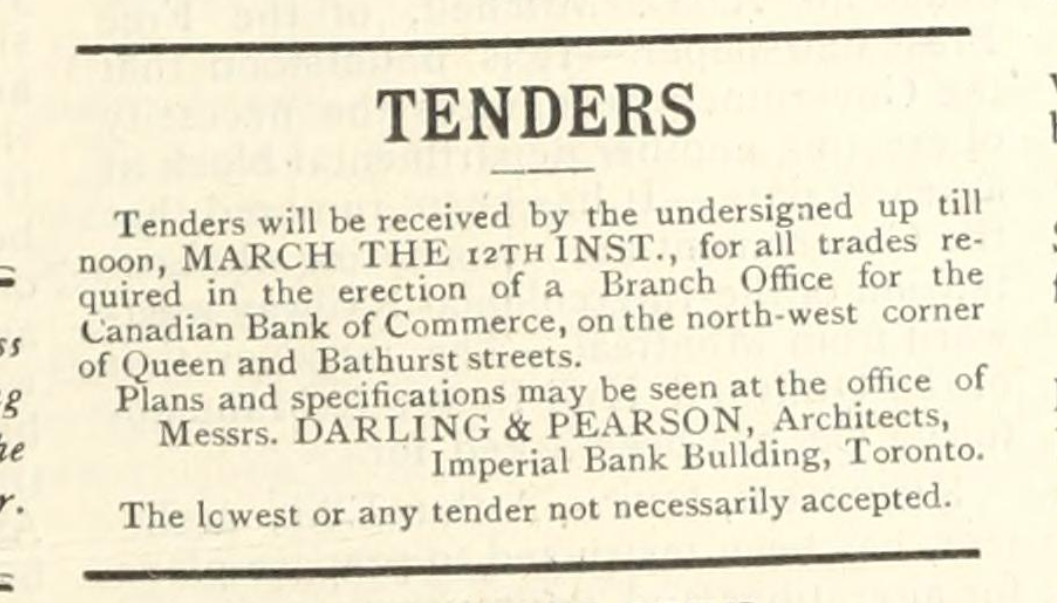

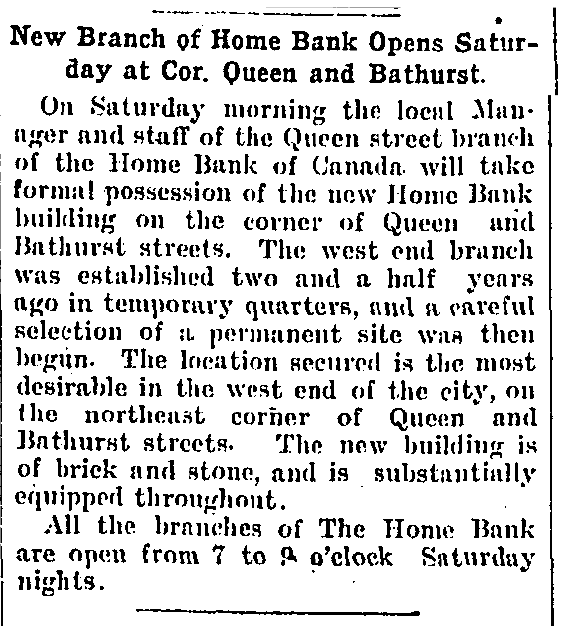

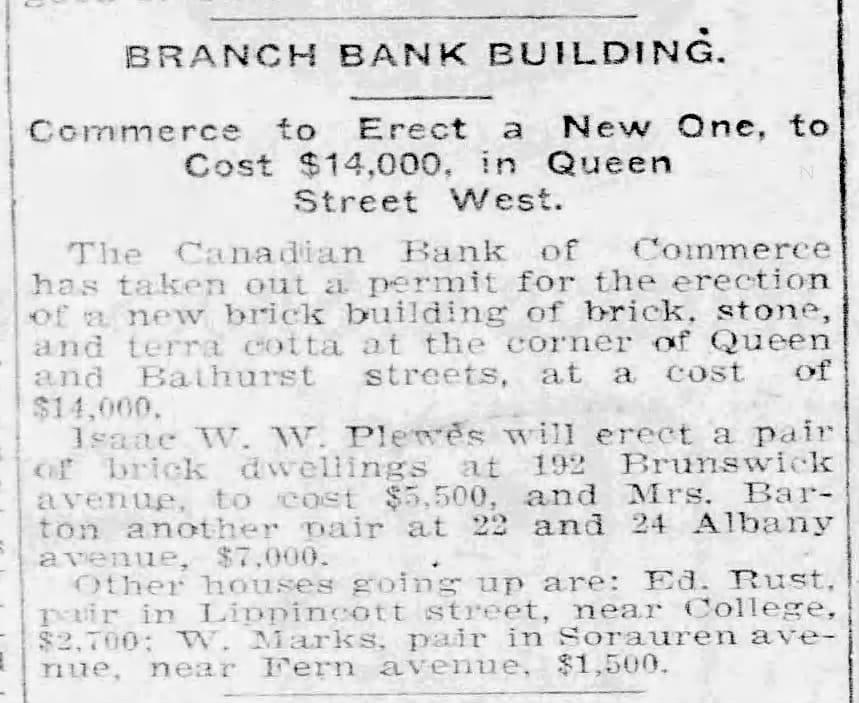

The Canadian Bank of Commerce arrived at the intersection first, completing their building on the left (588 Queen Street) in 1901. Designed by Darling & Pearson, the bank’s firm of choice, it's a sturdy example of neighborhood Edwardian Classicism. The Home Bank of Canada soon followed their competitor, opening up their branch across the street (on the right) in 1906, designed by A.R. Denison.

1901, request for tenders, Canadian Contract Record, the Internet Archive | 1901 article about 20th century building methods focused on the Canadian Bank of Commerce Branch

The Home Bank of Canada, founded in 1903, was a boomtime bank, characterized by shady loans, gross mismanagement, and negligible external audit oversight. Which, you know, worked so long as the boom lasted. Wartime spending and the post-war release of pent-up demand floated the bank for a while, but the tide went out in the early 1920s as crops failed, inventory piled up, and it became clear that the charlatans who ran the Home Bank had made some incredibly irresponsible bets.

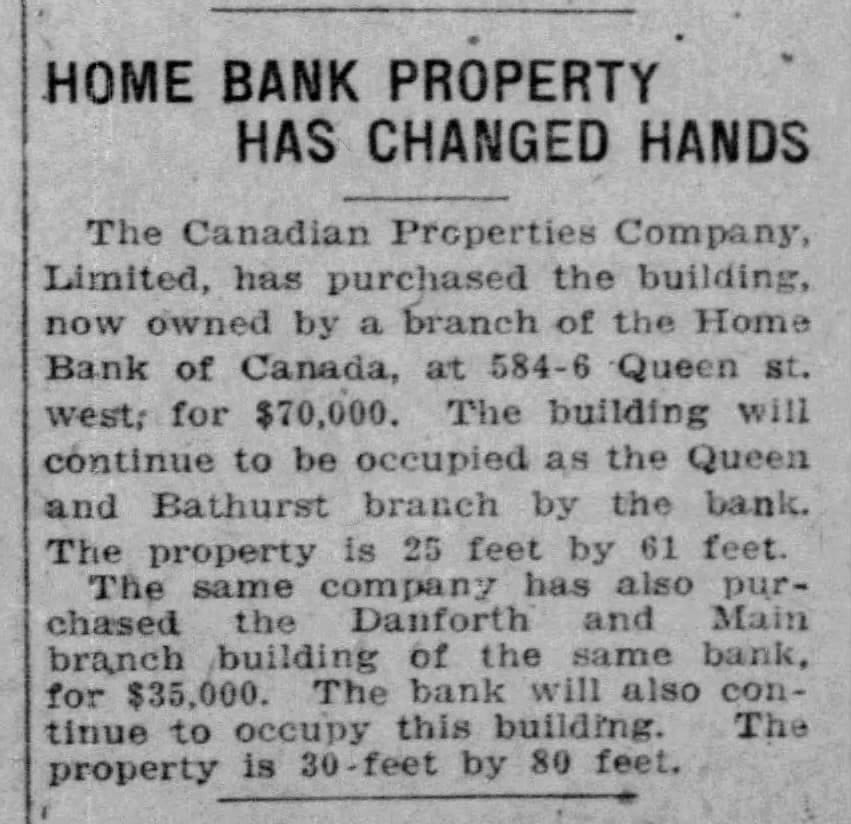

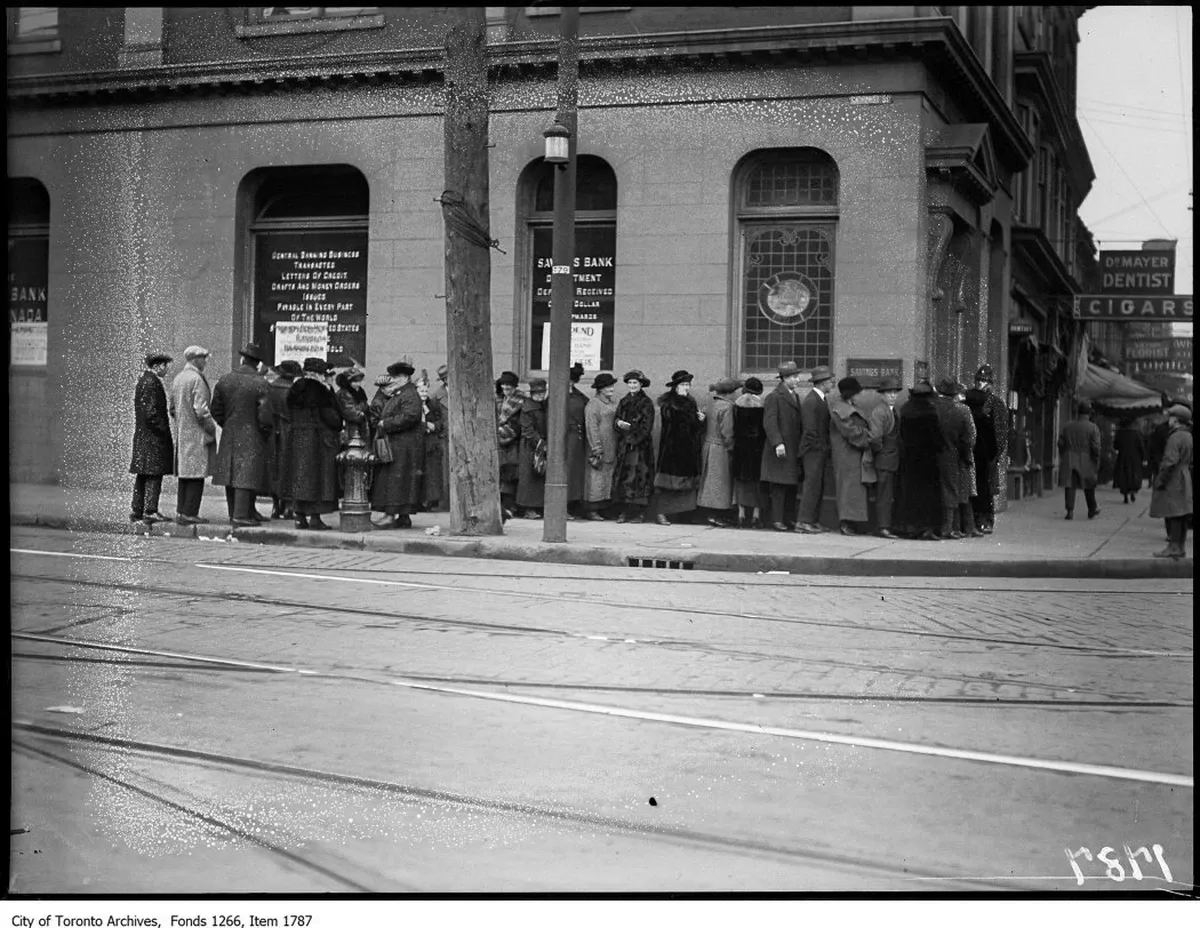

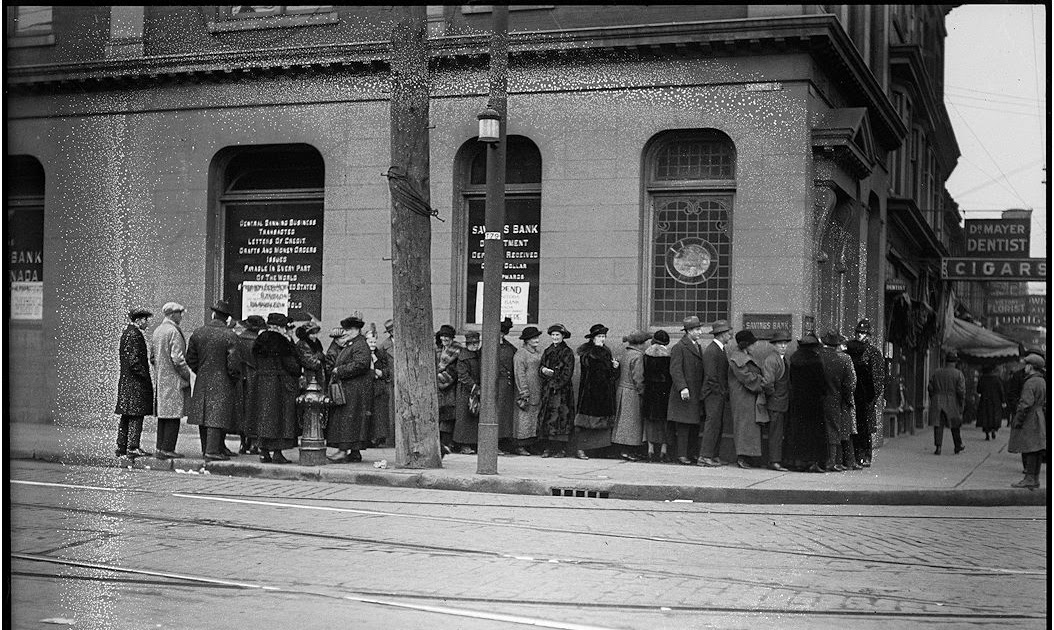

Potentially part of a desperate bid to scrounge up some cash, the Home Bank sold this building in 1923, intending to lease its space from the new owners, but within a few months, the Home Bank collapsed. Panicked Torontonians lined up at this branch to pull their deposits out of the failed bank (overwhelmingly in vain). 50,000 Canadians lost much of their money—a nightmare, but one that used to happen regularly in North America (...and one that a bipartisan group of dipshit American politicians are trying to bring back, by effectively legalizing cryptocurrency scams that will destabilize our financial institutions).

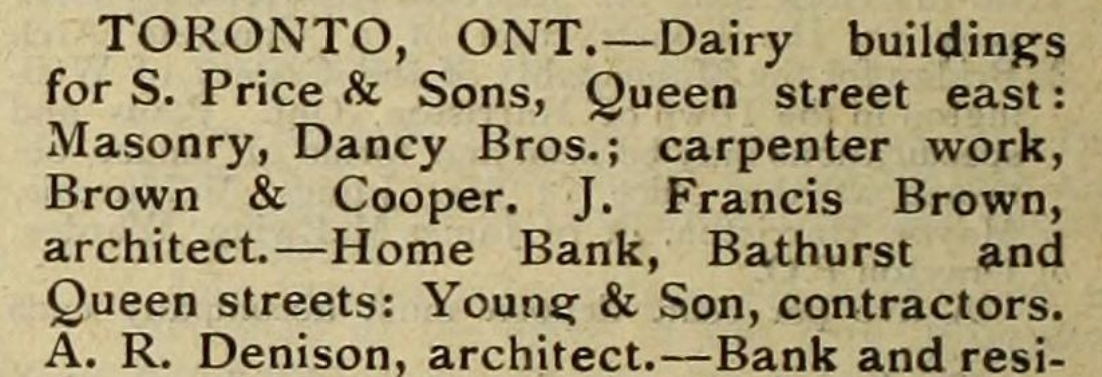

1906, building permit for Home Bank branch, Canadian Contract Record, the Internet Archive | 1906 article about the Home Bank branch opening and an ad for the new branch | 2023 photo of the building

The collapse of the Home Bank of Canada led to a major (if still stuttering) step towards the financial regulatory reforms that would protect regular people’s money. After investigating the collapse, a parliamentary committee recommended the use of deposit insurance in Canada—nearly a decade before FDR established the Federal Deposit Insurance Corporation in the US. Canadian Prime Minister Mackenzie King rejected that recommendation, but for the first time ever the Canadian federal government reimbursed some depositors for a portion of their losses. The fallout from the failure also led to the creation of the Office of the Inspector General of Banks, the precursor to the Office of the Superintendent of Financial Institutions, Canada’s bank regulatory agency (...real deposit insurance would come to Canada much later, with the formation of the Canada Deposit Insurance Corporation in 1967).

1923, Home Bank sells the building | 1923, bank run at the Home Bank, City of Toronto Archives | 1935 view of the intersection, City of Toronto Archives | 1935 view after rearranging some utility poles, City of Toronto Archives

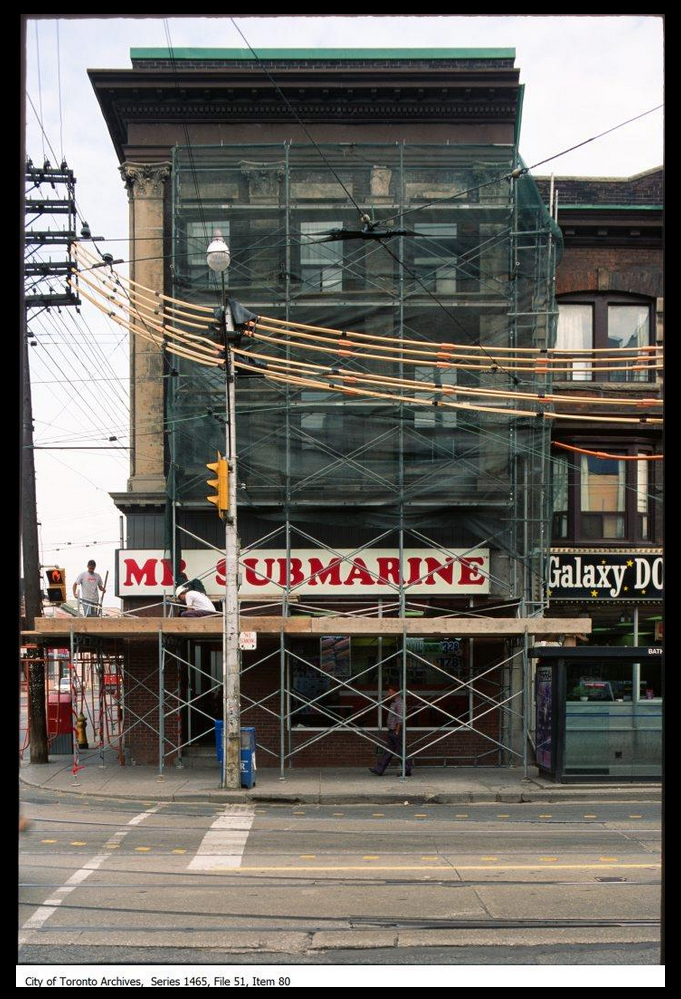

The Imperial Bank of Canada took over the branch in 1924, which put branches of two of Canada’s biggest banks across the street from each other. However, while bank failures dominated the North American financial system through the 1930s, the next century would be defined by banking consolidation. In 1961, the Canadian Bank of Commerce and the Imperial Bank of Canada merged, creating the Canadian Imperial Bank of Commerce—CIBC, one of the Canadian Big Five. The merger meant that CIBC would’ve had branches on both corners here, so they closed the IBC branch on the right in the former Home Bank building.

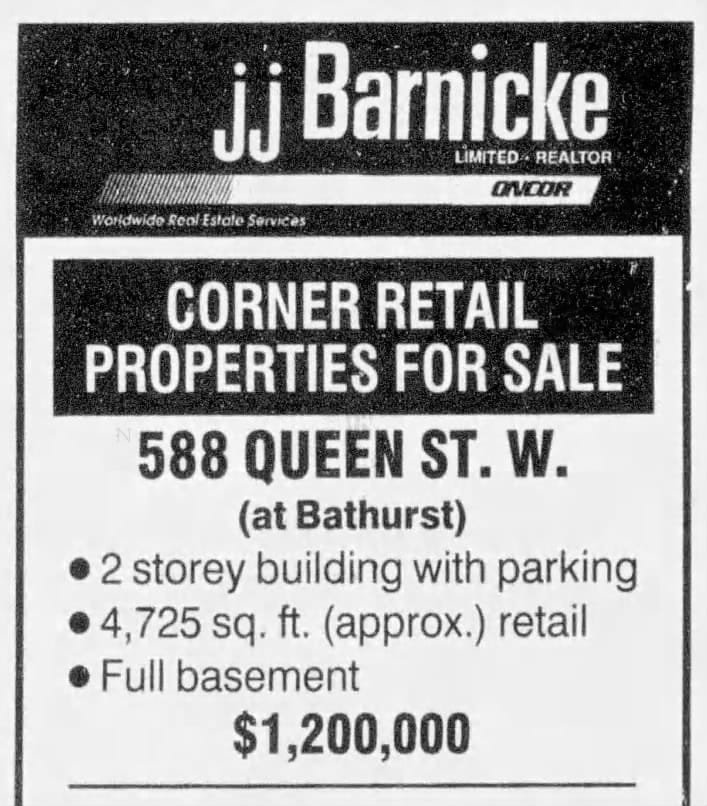

CIBC operated a branch out of the building on the left, the Canadian Bank of Commerce building, into the 1990s. That branch closed in 1993, and—with the help of a one-time capital grant of $1.1m from the Ontario Ministry of Health and a cut-rate sale price of $250k from CIBC (down from the $1.2m they marketed it for)—St. Christopher House bought the building in 1994. The settlement house turned the former bank into a social services drop-in center for people experiencing homelessness, as well as the organization’s administrative offices. The adaptive reuse project, designed by Levitt Goodman Architects, won an honorable mention in the 2001 Toronto Architecture & Urban Design Awards. Rebranded the West Neighbourhood House in 2014, it continues to host The Meeting Place drop-in center today.

Two undated photos, City of Toronto Archives | 1980-1994 photo, City of Toronto Archives | 1994 ad, CIBC building for sale | 1997 article about the St. Christopher House in the former bank | 2023 photo with streetcar

Both former bank branches have a heritage designation. 588 Queen Street West, Darling & Pearson’s CBC branch, was individually designated in 1973, and 584 Queen Street West, A.R. Denison’s Home Bank branch, is included as a contributing building in the Queen Street West Heritage Conservation District. In the Scott Pilgrim graphic novels, Bryan Lee O’Malley used the facade of 588 for the exterior of the Chaos Theater, the New York club owned by the villain, Gideon.

Production Files

Further reading:

- From Next Best to First Class: The People and Events That Have Shaped the Canada Deposit Insurance Corporation 1967–2017 by C. Ian Kyer

- (....i got a little too in the weeds on Canadian banking history)

- Money Matters: A Critical Look at Bank Architecture by Barry Bergdoll

- Institutional responses to bank failure: A comparative case study of the Home Bank (1923) and Canadian Commercial Bank (1985) failures

Some of the other permits and an ad for the offices above the Home Bank.

1901, 1906, and 1906

A few other photos where they make an appearance.

Member discussion: